Earning and saving money in 2025 has become a challenge. Inflation, changing lifestyle preferences, and the need for security for the future have forced all of us to think about how we can improve our financial situation. From personal experience, I can say that I am sharing with you in this article what I have learned in my journey. In this article, we will talk about saving, investing, and growing your money. And yes, it will include what I have learned—so that you too can improve your financial journey.

1. Adopt the right money habits

Saving money and growing it properly depends first of all on habits. When I started, I did not know where to begin. But as time passed, I learned that it is very important to maintain a balance between spending and saving.

Make a habit of saving

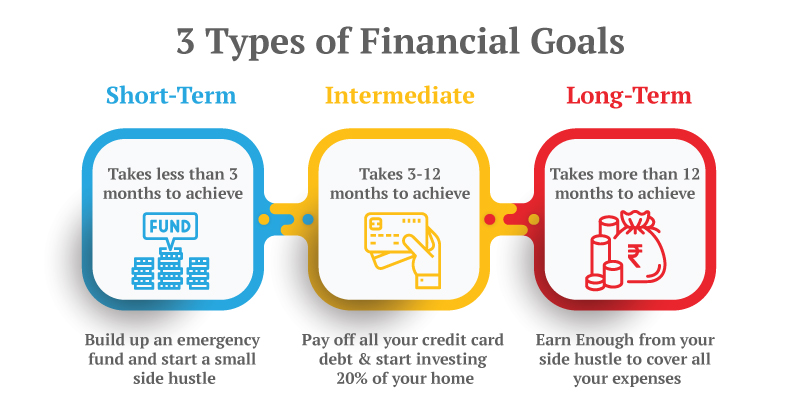

Make it a habit to save a certain portion of your income every month. Set small goals in the beginning—like saving up to 10% of your monthly income. This can be gradually increased to 20%. This habit brings confidence in life and lays a strong foundation for the future.

Control your spending

Make your budget and understand where you can reduce your expenses according to your income. I have seen myself that sometimes spending without thinking can put the future in trouble. Make a habit of reducing expenses which are not necessary.

2. Importance of investing and choosing the right avenues

Saving is important, but investing your money properly is even more important. Investing makes your money grow and you have more resources than inflation.

Stock Market and Mutual Funds

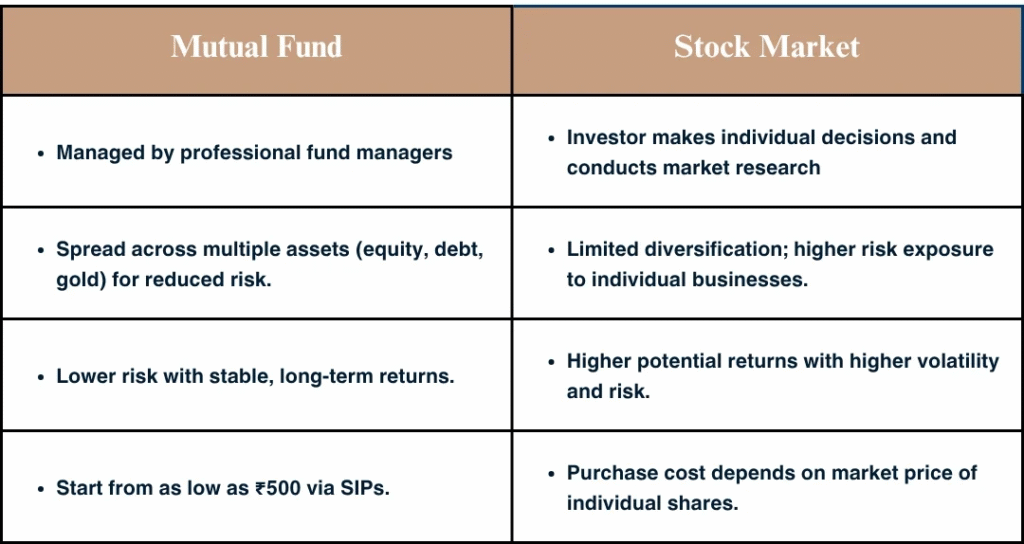

What I have learnt in my journey is that you can get good returns through instruments like the stock market and mutual funds. I was scared of it earlier, but when I did the right research and took advice from experts, I realised it is a great way to grow money.

Real Estate

Investing in real estate can also be a good option, especially if you have a small amount of money. It is a safe and profitable investment in the long term.

Investing in gold and silver

Semi-precious metals like gold and silver can also be good investment options. I have also seen that investing in gold can be profitable in the long run. It is a safe option, especially considering the economic uncertainties in the future.

3. Some more ways to increase money

While you save and invest money, it is also important to adopt other ways to grow it.

Create sources of side income

As I have found in my own experience, having a side income source, such as freelancing or a small business idea, can boost your income. I have also made good money from my freelance writing journey, which allows me to save some extra money apart from my regular expenses.

Take care of health and fitness

Spending on health is also a form of investment. A healthy lifestyle can help you reduce your medical expenses and avoid financial problems caused by diseases in the future.

4. Strike a balance between risk and safe investments

There is also risk involved in growing money, and it is important to understand this. I believe that instead of being afraid of risk, we should manage that risk properly.

Understand the ups and downs of the economy and the market

What I learned in my investment journey is that whenever a new investment option comes up, try to understand it completely. The more you understand the risk of investing, the better your decisions will be.

Blue Chip Stocks

In the world of investment, blue chip stocks can be a safe option. These are stocks of large and strong companies, which remain stable even during economic recession.

5. Maintain mental balance along with increasing money

It is important to grow and save money, but it is equally important to maintain mental peace. When I was facing financial difficulties, I realized that maintaining mental balance should be my top priority.

self-confidence and positive thinking

As I experienced, staying confident and always positive was the best way for me to deal with money problems. Whenever I made a new plan, I believed in myself that it could be a part of my success.

After all, it is all a long-term process. Saving, investing and growing money is a journey—one that depends on time and the right decisions. You will need patience and planning to grow your money in the right direction. I am no different in this journey—every day I try to learn something new and improve myself. This journey is not easy, but if you take steps in the right direction, you will definitely get success.

This article is for informational purposes only and should not be construed as investment advice. Always consult a financial advisor when making investment decisions.

#PersonalFinance #MoneyManagement #InvestingIn2025 #Carrerbook #Anslation #SaveAndGrow #FinancialFreedom #InvestmentTips #WealthBuilding #FinancialJourney #MoneySavingTips #FinancialPlanning

Leave a Reply